On average 8 out of 10 businesses fail in their first year of operation and only few go on to become global companies.

Several reasons have been put forward for such failures ranging from the lack of funding to the lack of a sizeable market. However, no matter what the reasons are, business failures can be traced to the lack of effective growth strategies.

Growth is pivotal for any business. It is the very rationale behind the establishment of a business.

Meanwhile, the lack of effective growth strategies has led to the demise of many well established companies by smaller ones through the disruptive innovation process (see Figure 1 below).

Figure 1: Disruptive Innovation

Figure 1 clearly shows a snapshot of big businesses that have been outcompeted and to a large extent chased out of the market by smaller businesses.

Arguably, these companies could have still been in the market today controlling the largest portion of it if only they were able to effectively strategise for sustained growth and survival.

Growth strategies can be defined as Strategies that lead companies to either compete or dominate their industries for as long as possible. It is the process of clearly and continuously spelling out what needs to be done and by when. Put simply, growth strategies are the innumerable decisions you make as a company on a daily, weekly, quarterly and yearly basis.

To grow, businesses need to ask themselves the following four fundamental questions:

1.Where are we now?

2. Where do we want to go?

3. How do we get there?

4. How do we know that we are there?

Each of these questions presents an opportunity to crucially assess your internal and external environment and effectively plan for any sudden shock from the market. Here is a brief analysis of the questions:

Where are we now?

This question prompts you to look at your current situation as a business. You can do this by asking critical questions like: how are we doing? What’s our core competence? Are our customers and staff happy ? What’s the current sales figure? Who are they current and new entrant to the market? What is our current overheads?

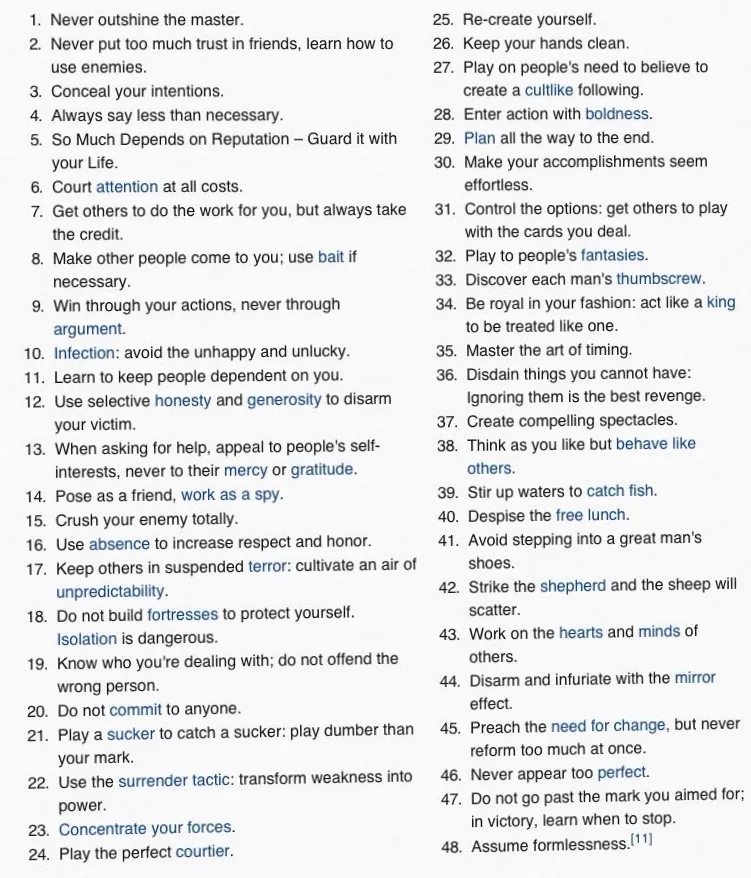

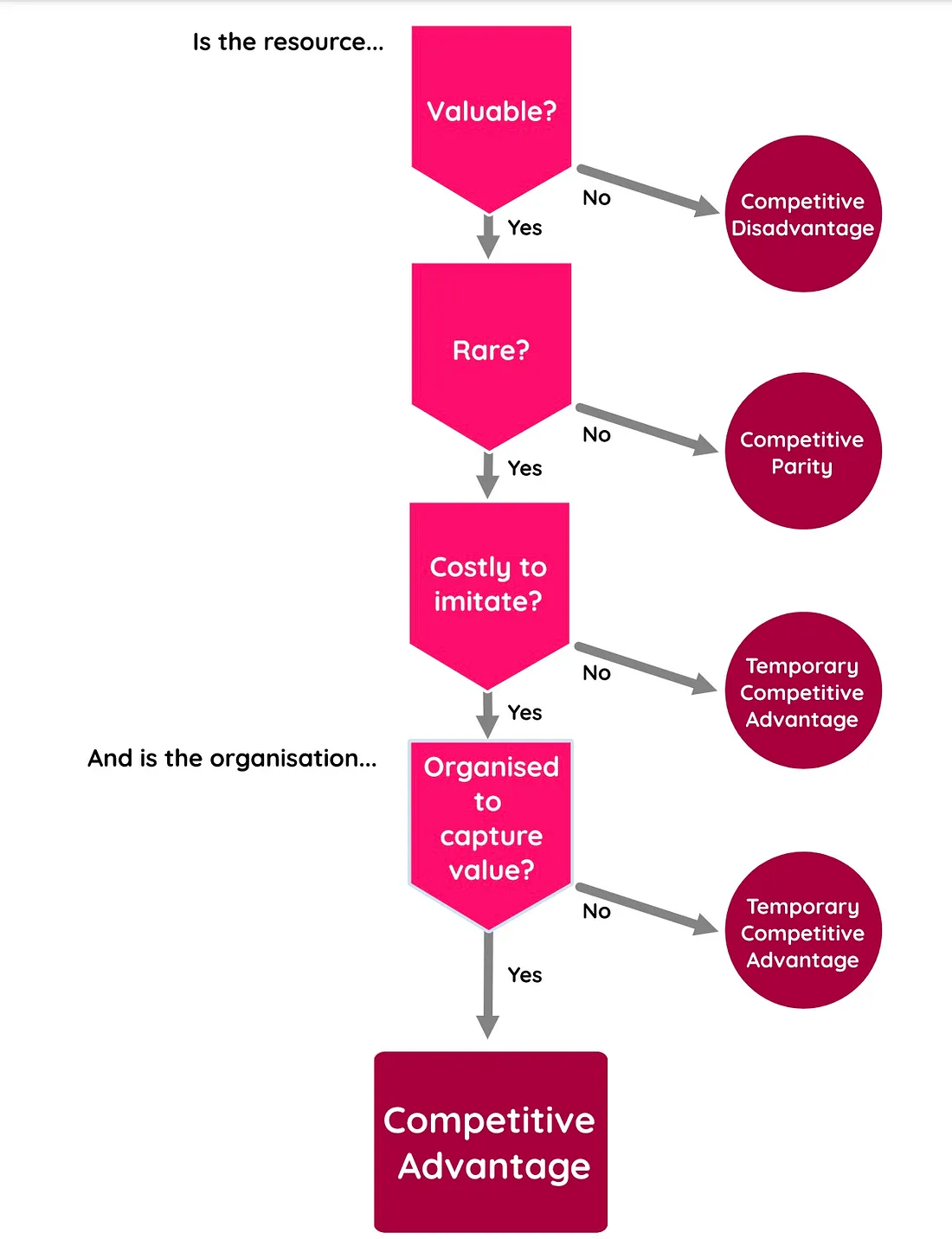

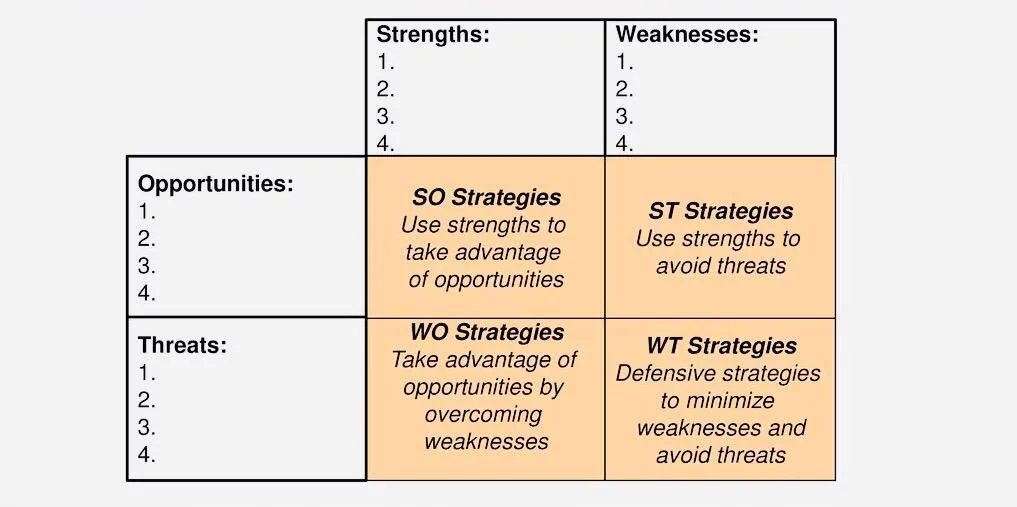

To be more structured, you could use key strategic models like SWOT, VRIO and McKinsey 7s to carry out your situation analysis.

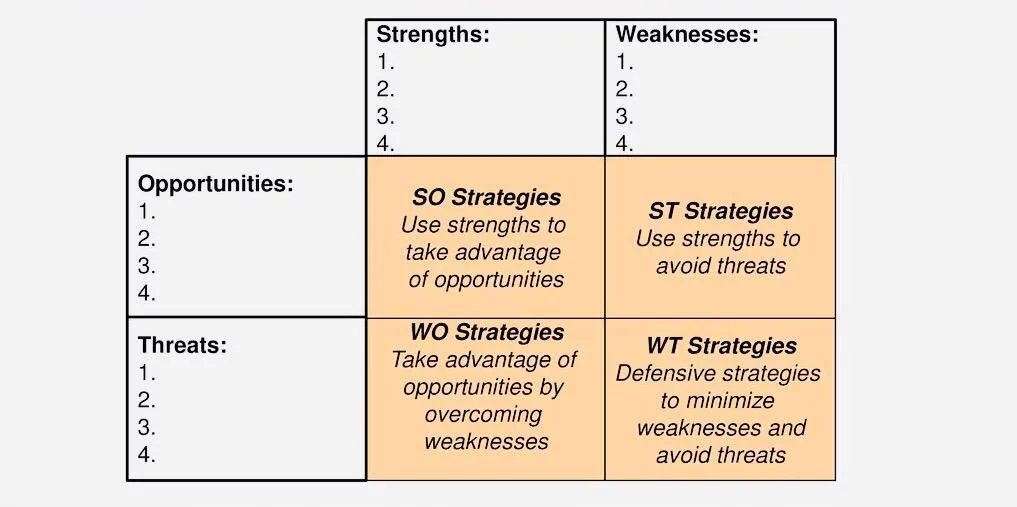

For example, SWOT (shown in figure 2 below) could be used to ask key questions like: what are my Ss (Strengths), Ws (Weaknesses), Os (Opportunities) and Ts (Threats)?

Figure 2: SWOT Analysis

The answers to these questions will help you to use another SWOT related strategic model called the TOWS (Threats, Opportunities, Weaknesses and Strengths) matrix (shown in figure 3).

Figure 3: TOWS Matrix

The TOWS Matrix is used to effectively counteract your threats, take advantage of your strengths and exploit your opportunities.

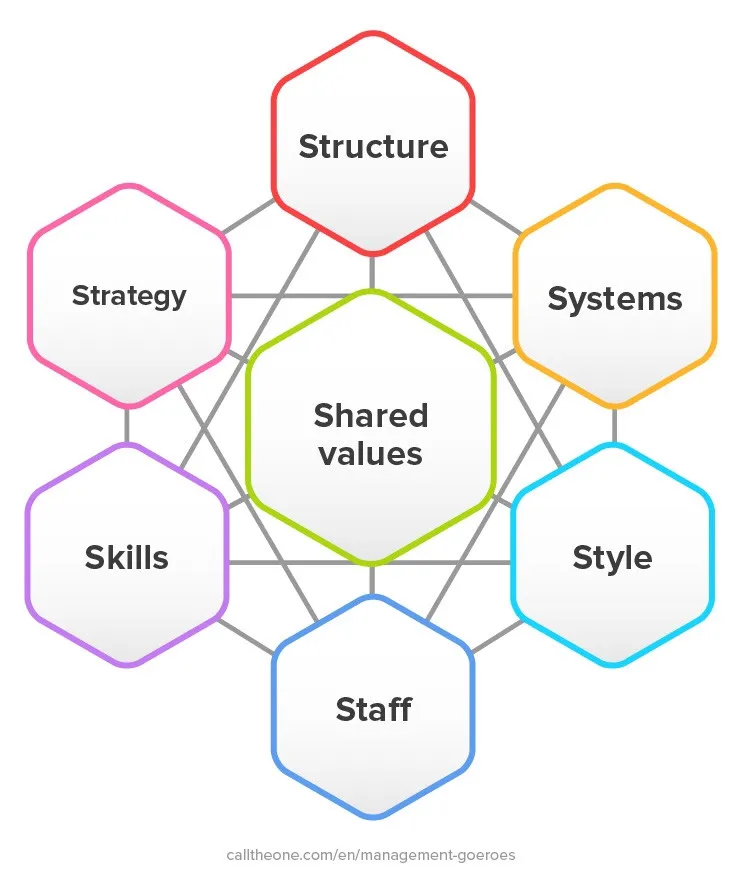

The McKinsey 7s (shown in figure 4 below) which was developed by the US based consulting firm, McKinsey, allows you to review the effectiveness of your business by looking at the interrelationship between your Strategy, Systems, Staff, Style, Skills, Structure and Shared-value.

Figure 4: McKinsey 7s Framework

2. Where do we want to go?

This is the question of the future. It clearly requires you to set and/or review four key vital components of your strategic plan: Vision, Mission, Objectives and Tactics ( herein referred to as VMOT).

A company’s vision clearly states its long term direction. Vision helps in painting the picture of the type of company you would want to see in the foreseeable future. To a large extent your vision describes your ideal state including what is unique about your product offering. The vision statement of Google for instance is “to provide access to the world’s information in one click.”

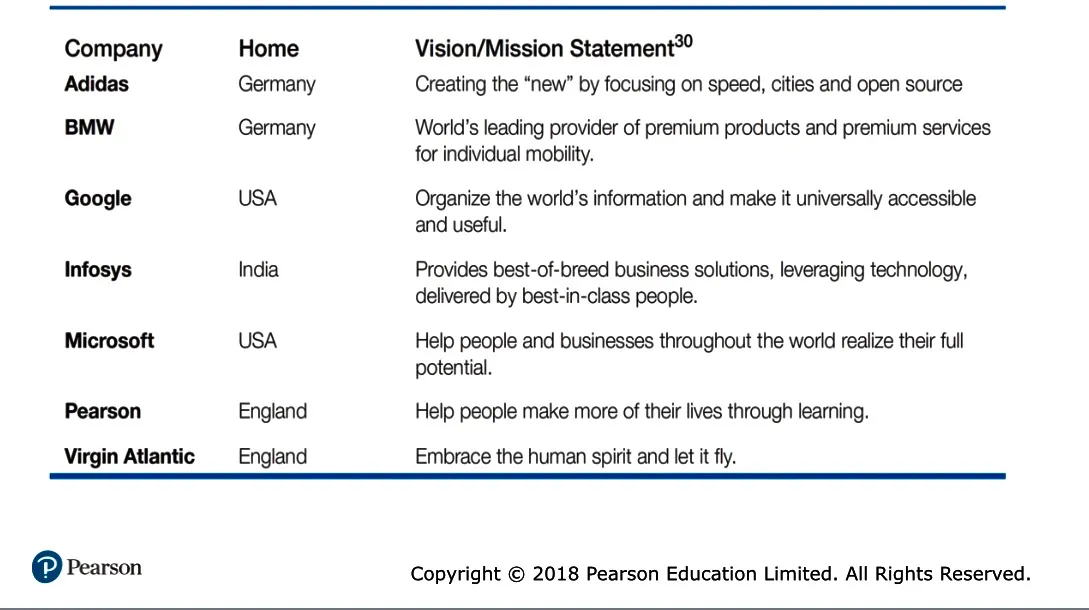

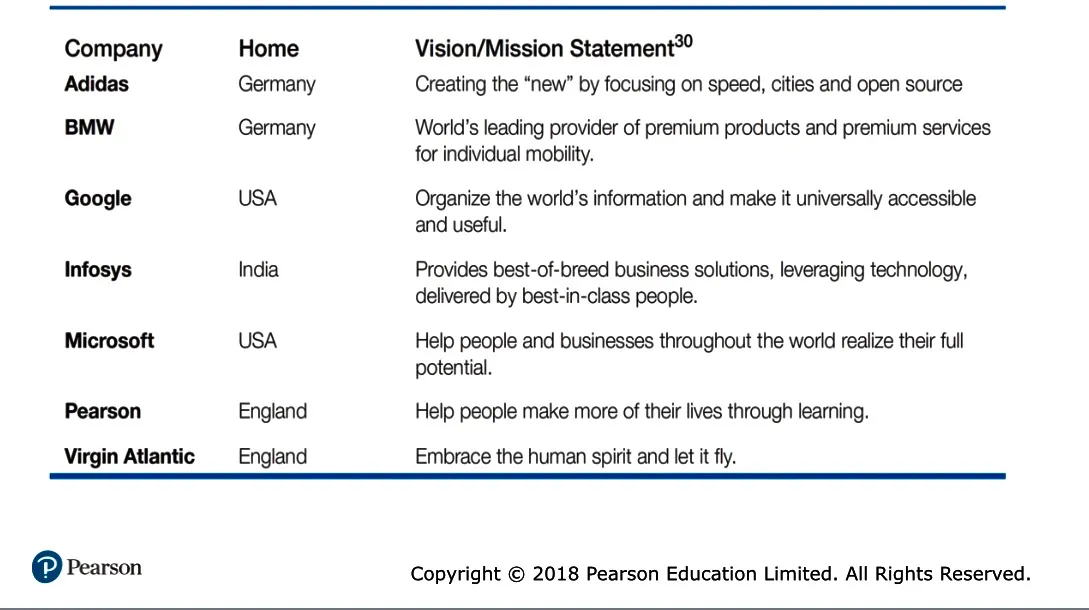

A mission on the other hand captures the purpose of your business. It clearly spells out your Why? Figure 5 below shows examples of vision/mission statements by some of the most prominent businesses today.

Figure 5: Examples of Vision/Mission Statement

An objective on the other hand focuses on the short term goals that needs to be achieved. Objectives are derived from your vision and should be Specific, Measurable, Achievable, Realistic and Time-bound (SMART).

Tactics are the specific and practical steps taken to achieve your objectives which will inadvertently lead to the achievement of your vision and mission.

3. How do we get there ?

This question allows you to strategically determine your road map towards the vision of your company. Your road map is the bedrock upon which all other components of of your business sits on. The more clearer and precise it is, the more easily you can sail towards your vision.

To strategise, companies normally use key models like Ansoff Matrix, Porter’s Generic Strategy and Bowman’s Clock.

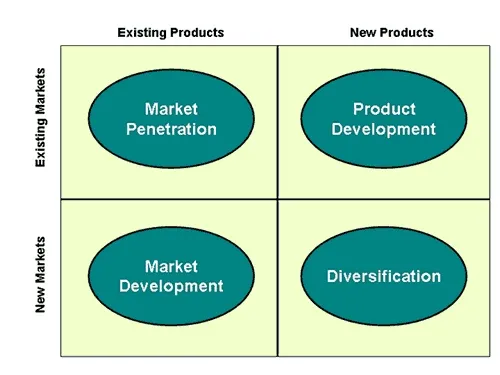

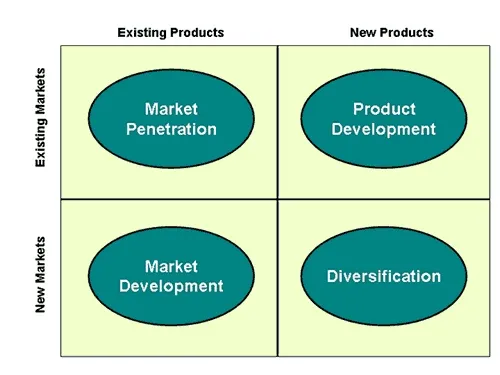

Ansoff’s matrix was developed by Igor Ansoff and was first published in the Harvard Business Review in 1957, in an article titled “Strategies for Diversification.”

The model has been widely used by small-medium as well as large companies to expanded their operations and maximise their bottomline. The model (shown in figure 6) identified four main strategies: market penetration, product development, market development and diversification.

Figure 6: Ansoff Matrix

A market penetration strategy is when a company decides to sell or produce more of its existing products to its existing market. You do this because you know that the product works and that there are very few surprises in the market.

Product development strategies is when a company decides to produce and sell their new products to their existing market.

On the other hand, market development strategies is when a company decides to sell their existing products to a new market whereas diversification strategies seek to sell new products to an entirely new market.

Porter’s generic competitive strategy (shown in figure 6 below) was developed by Michael Porter in 1978. Porter stated that a business can compete in three main ways: cost (being the lowest producer), differentiation (offering products that are unique to the market) and focus (focusing on a specific niche).

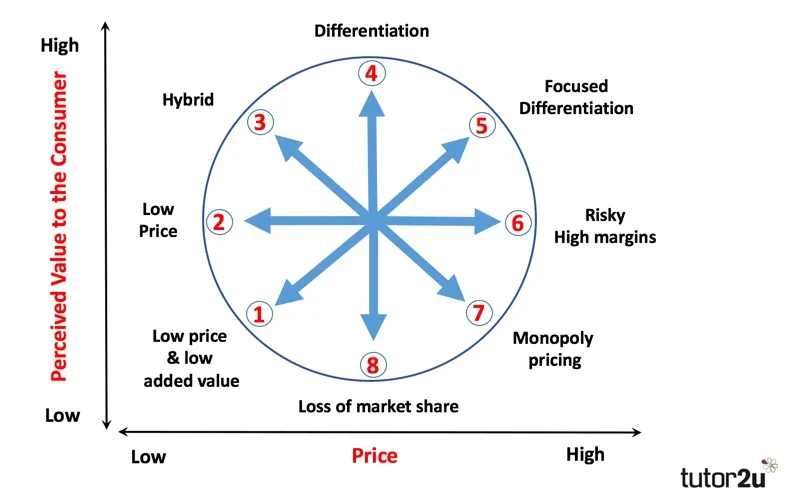

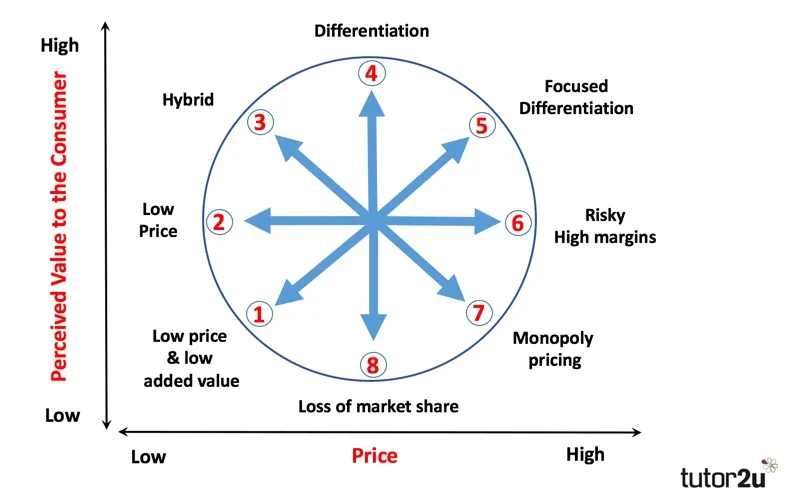

Bowman’s Strategic Clock is a competitive model that guides businesses on how to effectively position their products in the market. Broadly speaking, Bowman’s clock gives the options to businesses to position themselves based on two main dimensions: perceived value and price; both of which can be either low or high as show in figure 7 below.

Figure 7: Bowman’s Strategic Clock

As shown above, there are 9 key ways of positioning in the marketplace, each of which is centred on the two dimensions of price and perceived value.

4. How do we know that we are there?

Having carried out your situational analysis, set a clear vision and mission, adopted appropriate strategies and techniques, it is important to clearly set some Key Performance Indicators (KPIs). KPIs allow you to assess your company’s progress against your vision and objectives as you carefully implement your chosen strategies.

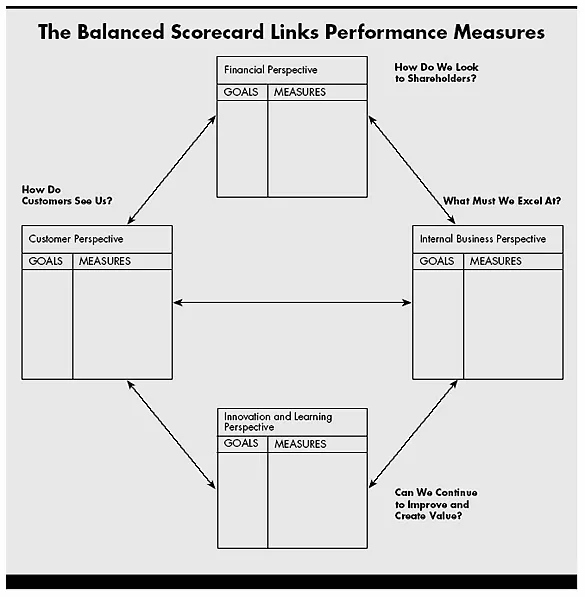

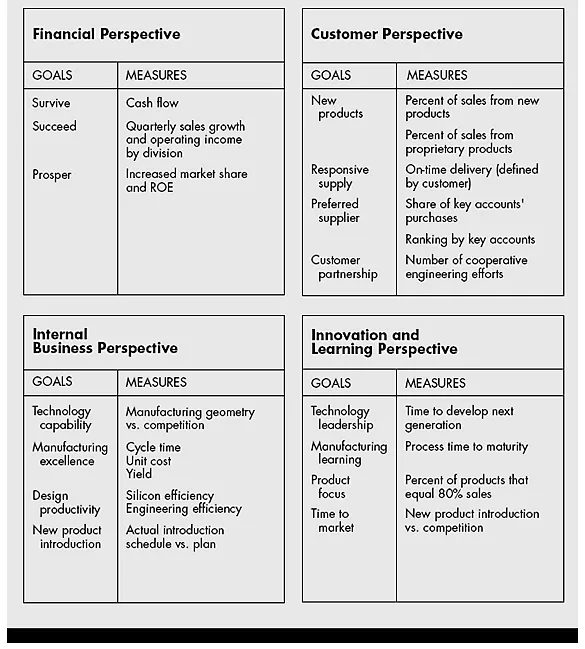

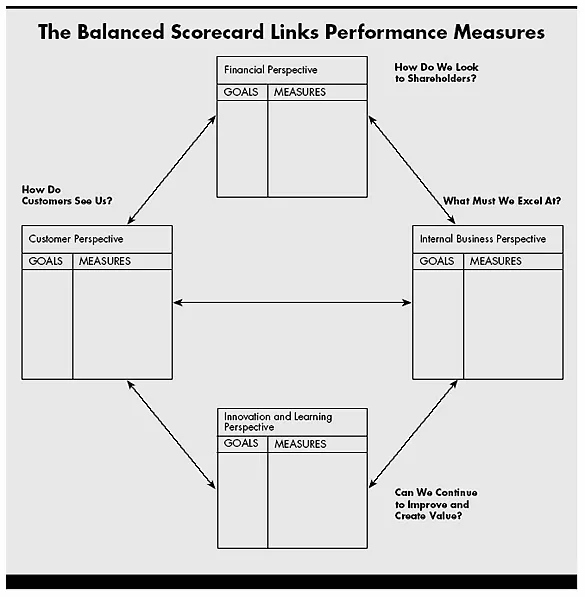

One of the key models that is widely used by companies to set KPIs is The Balanced Scorecard (shown in figure 8 below). The Balance Scorecatd was developed by Robert S. Kaplan and David P. Norton. KPI compromises of a “a set of measures that gives top managers a fast but comprehensive view of the business” (Kaplan and Norton, 1992).

Figure 8: The Balance Scorecard

Source: Kaplan and Norton (1992)

As shown in figure 8 above, it can be seen that the model is divided into four sections:

- Customer perspective (How do customers see us?)

- Internal perspective (What must we excel at?)

- Innovation and learning perspective (Can we continue to improve and create value?)

- Financial perspective (How do we look to shareholders?)

These three questions will help to clearly ascertain where you are at, as an organisation.

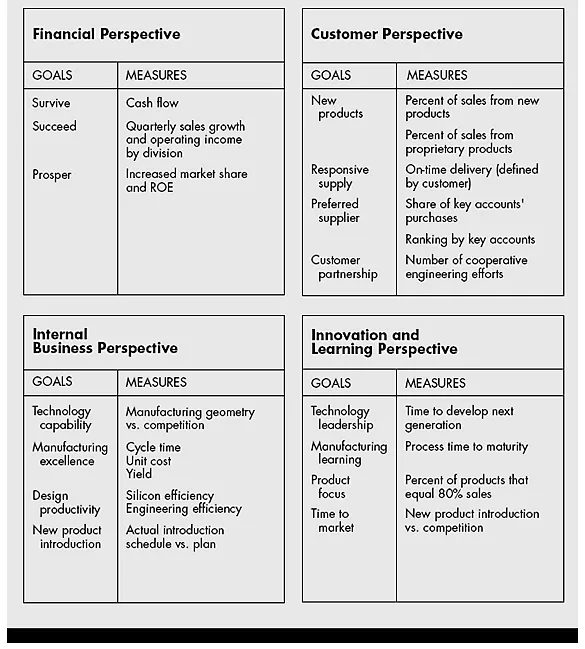

A typical example of a balance scoreboard of a company Kaplan and Norton referred to as Electronic Circuits Incorporated (ECI) is shown in figure 9 below.

Figure 9: ECI Balanced Scorecard

In conclusion, the business environment in which organisations operate today is constantly evolving. Thus, for SMEs to thrive, they will need to constantly review their activities by asking themselves four key questions:

- Where are we now?

- Where do we want to go?

- How do we get there?

- How do we know that we are there?